Real Estate Blog

Residential rental yield in Chania, Greece for 2021

28 May 2022

Buying a home for investment in Crete. What you need to know about the annual income of a property. How did the yields in Chania form in the second quarter of 2021. What factors affect the fluctuations of the index and how is it expected that the yield of housing in Chania will move in the future.

Buying a home as an investment

Buying real estate for investment purposes is one of the first forms of investing in real estate. Especially for the Greek investing public, the purchase of a property with the aim of generating income from rent is one of the traditional investment options.

After the ten-year recession, investing in the real estate market is becoming an increasingly attractive option as the recovery in selling prices raises expectations for the production of future added value. However, apart from the expected capital return, there are also expectations from the income return of a property through its lease.

From a financial point of view, in order to decide which investment is the best option, you must first calculate the return on investment. Yield functions as a key measure of comparison between different types of investments. Usually, high return implies high risk.

Annual rental yield in Greece

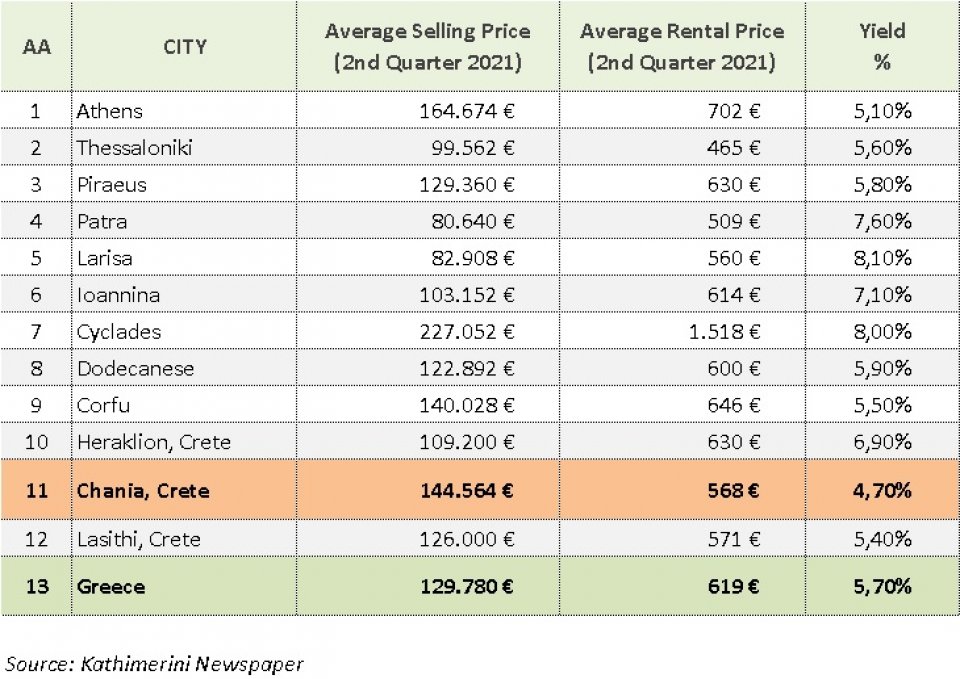

In a survey published in Kathimerini referring to the 2nd quarter of 2021, the average annual rental return in Greece was 5.7%. In the table below we have selected and presented to you the relevant odds in different regions of the country:

At this point let us clarify that from region to region the properties have different quality characteristics. This is reflected in the average selling price, where for example in the island areas (Crete, Cyclades, Corfu) we see that it is higher than the mainland areas of the country (Larissa, Ioannina, etc.). Therefore, this factor should also be taken into consideration when comparing performance.

We also emphasize the fact that this index does not incorporate taxes and expenses that are borne annually by a rented property. If taxes and expenses are taken into account, the resulting net return will be from 1% -1.5% lower. We have mentioned in our previous article when it is wise to use the index before taxes and expenses (gross) and when the index of net income return.

Residence annual yield in Chania

As shown in the table, the average yield for Chania for the second half of 2021 was 4.7%. The index is formed by a mixture of different types of housing, of which some categories move above average and others below average.

An example of real estate whose performance is above average is student housing. Small apartments (studios) for the last 20 years are constantly in high demand for rent. The presence of the Technical University of Crete (Kounoupidiana, Akrotiri) and the TEI (Chalepa) has contributed a lot to this. These are two large institutions that are constantly expanding and steadily increasing the demand for student housing. Especially in Chania the demand is consistently higher than the supply. This is proved by the fact that the city of Chania has one of the highest - nationwide - rents per sqm in student houses (average 8.5 € / sqm for non-furnished and over 10 for furnished).

Short-term leasing through the AIR BNB is also a phenomenon with a large impact on the housing market. The reason is that through the short-term lease, a comparatively higher income is achieved (it can even reach twice as much depending on the characteristics of the property and its management) than what the long-term lease provides. This is also proved by the fact that more and more property owners prefer this model to long-term urban leasing.

Factors that affect the Performance Index

A very important factor that shapes the climate and influences prices, and therefore performance, is the expectations for how the economy and the market in general will move in the near future.

Especially for Chania, in the news and only for the increase of tourism in the coming years, people translate this information into a promising development and try to discount this profit by increasing the prices.

Infrastructure is also an important factor that directly affects prices, both for sale and rent. An example is the design for the construction of BOAK (upgrade of the national highway), a project that for Crete is compared to the regeneration in Elliniko, in the so-called Attica Riviera.

Equally important is the role of institutional investors. Large investments in Tourism have an indirect but significant and gradually increasing impact on the housing market in Chania. For the time being there is a significant housing problem for the staff of the Hotel employees, ie the demand is greater than the supply, which pushes the prices upwards.

Finally, an important factor that affects prices, not only in Chania obviously, is the alternative investment options. As long as interest rates fluctuating at such low levels, real estate seems like a very attractive option with good returns and controlled risk.

© 2022 - 2025 Broosco. All rights reserved

Related Articles

Don't miss the conversation!

Join us to get the information you need, straight to your inbox...

SIGN UP