Real Estate Blog

Investing in Real Estate - How Is The Yield Calculated

20 Oct 2021

How to calculate the yield of a property. Which major factors affect the creation of profit. Why is the resell value important. When a personal loan is a good idea? Example of rental income.

Investing in real estate in recent years is becoming more and more attractive as an option. After

the collapse of prices during the 10-year recession experienced by Greece, the local real estate market has entered a multi-year - apparently - upward cycle. In addition, the significant increase in savings caused by the pandemic and lockdowns, combined with around zero interest rates (the average pre-tax interest rate is 0.2%) is also a factor that directs households to invest their savings in real estate.So if you are considering investing in a property, it is very important that you can identify two things as accurately as possible:

- the yield of the property

- the resale value of the property

If nothing else, these two factors are the most important in making your decision. To make it more understandable we give an example and accurate calculations on the assumptions of the example.

Example - Assumptions

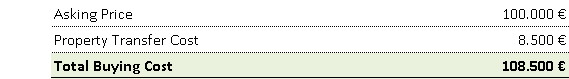

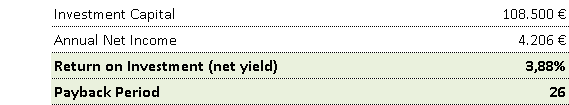

Suppose you want to buy an apartment at a price of 100,000. Transfer costs (taxes, fess, etc) that burden the buyers range from 8% -9%. So let the costs amount to € 8,500. So the capital you will invest in total amounts to € 108,500.

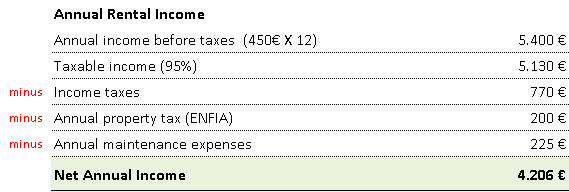

Assume you sign a long term lease to rent your property for a monthly rent of 450 €.

![]()

Annual income, taxes and expenses are shown in the following table:

Yield from renting the property

As it results from the above assumptions and calculations, the net amount that the investment will bring you on an annual basis amounts to € 4,206. If you divide this amount by the total capital you have invested, you will find the net return on your capital for one year. In this example this yield amounts to 3.88%.

Assuming that this will be the net return on the property for the years to come, then dividing the total amount of the investment by the annual return, you will find the time it takes to pay off the initial capital invested. In our example it is 26 years.

Yield from selling the property

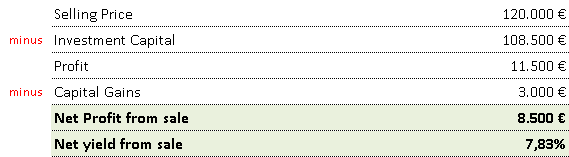

So, by buying a property you have converted the deposits with almost zero yields to an annual yield of 4%. However, this is not the only profit you make. If you sell your property in the future at a higher price than the amount you allocated for its purchase, this difference is also a profit. So it is very important to approach the increase in the value of the property that will occur over time, to check if your investment is promising. Of course, it is not easy to know the future and the trends of the real estate market, however if the market in general has upward trends then it is very likely that the value of the property will increase in the future.

For reasons of completeness of the article we will make a brief reference to the capital gains.

Capital gain is an increase in a capital asset's value and is considered to be realized when the asset is sold. These gains are taxed with 15%. Practically in the above example, if you sell the property at 120.000 the 15% capital gains tax will be calculated in the amount of 120.000-100.000 = 20.000.

In our example, the amount of return on sale (assuming there is a capital gains tax) would be as follows:

Total Return on Investment

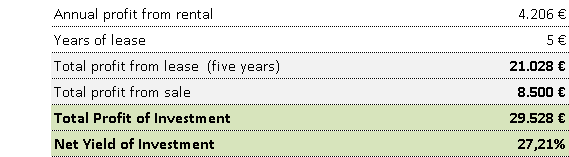

To calculate the total return on investment you must add all the net cash inflows created during the time the property was in your possession. In our example this would mean that we would add

- the net annual return for all the years we had the property plus

- the profit from the resale.

Suppose you sell the property after 5 years at the price of € 120,000. The overall return on investment is shown in the following table:

As shown in the table above, the total return on your initial capital (€ 108.5000) within 5 years yielded a total of € 29,528, ie 27.21%, which corresponds to an average annual percentage of 5.5%.

When should you take out a bank loan?

It is also very important to have a basic knowledge of when it is worthwhile to take out a bank loan. A simple rule of thumb is to compare the annual return on investment with the annual cost of the loan. In the example above we saw that the net return on capital you invest is about 4% per year. So if the bank interest rate is lower than your net return, then it is in your best interest to get the loan. In other words, the rent you will receive monthly:

- will cover the monthly installment of the loan and

- will leave you an amount to save

In this case, the total annual return on your investment will be reduced by the annual borrowing cost.

Financial leverage

Where it really makes sense to take out a loan is when the amount of your savings (Equity) is not enough to buy a property that has been found to have a good yield. So let's say you have saved € 75.000, which you have in term deposits with an annual interest rate of 0.25%. However, if you take a loan to cover the difference up to € 108,500 and buy the property, then you will essentially secure a 4% return on all funds. Basically, you will put the loan amount to work for the benefit of your own deposits. This use of foreign capital (borrowed money/debt) to finance the purchase of assets is called financial leverage.

The risk in an investment

In every investment you intend to make there is the potential profit and the corresponding risk. Your main concern should be to minimize the risk and secondarily to maximize the profit. In any case, need to be properly informed about the real estate market and also familiar with the concept of yield in real estate. This way you will eliminate most of the risks and avoid choices that may lead you to a dead end.

Do not hesitate to discuss with your real estate agent or your financial advisor. They may present you with a good opportunity or reveal the risk in a choice you intend to make. In any case, Broosco Team wishes you "Good Luck".

Broosco Free Online Tools

© 2021 - 2025 Broosco. All rights reserved

Related Articles

Don't miss the conversation!

Join us to get the information you need, straight to your inbox...

SIGN UP