Real Estate Blog

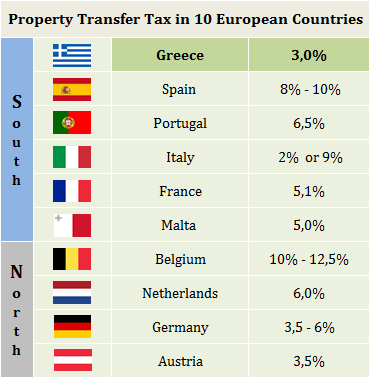

Property Transfer Tax in south and north Europe

02 May 2015

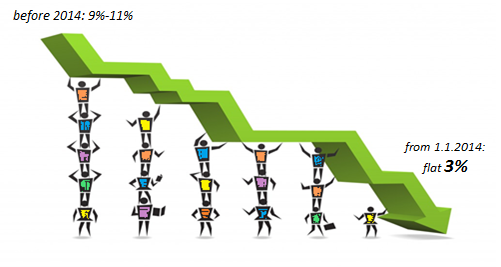

Till December 2013 the property transfer tax in Greece raised to 9-11% on the declared sale price. Since January 1st 2014, when the Law 4223/2013 was implemented, Greece has adopted one of the lowest property transfer tax rates in Europe. (3%)

As far as the annual property tax is concerned, each property is burdened with a tax, the so called "ENFIA". The tax calculation is the result of multiplying several features of the property such as the property's size (square metre), location (the zone value), age, the floor, etc.

Spain

Property Transfer Tax: Transfer Tax (I.T.P.) is scaled at 8%, 9% & 10%. It is payable by the buyer for the purchase of any real estate (villas, flats, land, commercial premises, garages), provided the vendor is not a developer or normally trading in the business of resale properties. Buyers of brand new houses in Spain are liable to paying 10% IVA (VAT) if the house is finished or is being built at the time of the purchase.

Annual Property Taxes: The "Impuesto sobre Bienes Inmuebles" , known as IBI, is fixed by the local authorities, depending on both the value of the land and of the property itself. This Spanish tax is paid yearly, and you can either go to the local tax office and pay it directly when you receive the yearly notice in your postbox, or you can arrange for it to be paid automatically from a Spanish bank account. You will be able to find out how much it is from the estate agent or seller you are dealing with at the time of purchase of the house in Spain, but the amount increases slightly each year.

Portugal

Property Transfer Tax: Property Transfer Tax is levied at a flat rate of 6.5%. The tax base is the selling price of the property or current market value of the property, whichever is higher. Stamp duty is levied at a flat rate of 0.80%. The tax base is the selling price of the property or current market value of the property, whichever is higher.

Annual Property Taxes: The owner of a residential property whether it is used by themselves or leased out, must pay a local tax known as "Imposto sobre Municipal Imoveis" (IMI). This tax is raised and spent by the town hall and must be paid by the end of April each year of the amount is not greater than €250. Amounts over €250 are paid in two equal payments due in April and September. If the calculated tax is not greater than €10, no payment is due. If the value of the property is less than €157,500 there is an exemption period of six years. If the value is between €157,500 and €236,250 this period is reduced to three years. These exemptions are applicable to both residents and non-residents. The amount due is calculated differently for homes built prior to 2003 than for those built after that year.

Italy

Property Transfer Tax: On 1 January 2014, a new tax system for real estate transfer agreements came into force. The reorganisation of registration tax rates provides only 2 proportional rates for all real estate transfers. 2% in case of transfer of non-luxury residential buildings designated to be the main dwelling of the purchaser. 9% in all the other cases. Registration tax applied with the proportional rates cannot be in any case lower than €1,000.

Annual Property Taxes: Property tax is paid by everyone who owns property or land in Italy, whether resident or non-resident. It’s levied at between 4% and 7% of a property’s fiscal value, the rate being decided by the local municipality according to a property’s size, location, age, condition and official category, as shown in the property deeds. Categories are decided by the land registry 0according to the type of property.

France

Property Transfer Tax: There is no French VAT, known as TVA, payable on property that is more than five years old. But registration taxes of 5.09% are payable on the purchase price. If you buy a new build property there are no registration taxes or TVA, but if you resell it within five years then TVA at 5.5% is payable on the sale value.

Annual Property Taxes: If you own a property in France, then the local property rates payable comprises two different taxes , Residence Tax (taxe d’habitation) and Ownership Tax (taxe foncière). Local authorities also charge rates on business premises, called the "Contribution Economique Territoriale" (CET). Even if you run the business from your from home you will still be liable for these rates, although there are certain exemptions and other concessions.

Malta

Property Transfer Tax: 5% Duty on Documents calculated on the purchase price of the immovable property. If the Buyer is a European Union Citizen declaring on deed that he shall reside in the property being purchased as his sole ordinary residence, then the preferential rate of 3.5% is applied on the first €150,000 of the price.

Annual Property Taxes: There are no property taxes levied in the Islands of Malta.

Belgium

Property Transfer Tax: When purchasing a house in Belgium, the buyer is normally required to pay a transfer tax on the purchase price due the passing of title to property from the seller to the buyer. In the Flemish Region, real estate can be registered at a flat rate of 10%, while the tax rate amounts to 12.5% in the Brussels-Capital and in the Walloon Region.

Annual Property Taxes: It is a percentage of the Revenue cadastral and is charged by the regions. The rates are a combination of the general regional rate (for Brussels, Wallonia and Flanders) and the local municipality rate. There is no harmonised level, so the rates vary from region to region and from municipality to municipality.

Netherlands

Property Transfer Tax: Property transfer tax in the Netherlands is 6%. If the property is newly constructed (or less than two years old) the Transfer Tax is replaced with the 19% VAT.

Annual Property Taxes: Real estate taxes are based on the value of the property and are paid by both the owner and the user. Each municipality is entitled to determine its own tariffs for real estate taxes which are applicable for four years. The tariffs (owner and user tariff) for the real estate taxes are typically between 0.1% and 0.3% of the property value. Besides real estate taxes, municipal authorities levy other taxes and charges such as building charges that are related to building permits. Such charges can be very high so a critical review is advised before payments are to be made. Other possible taxes include polder board taxes orland-draining rights, wastewater pollution tax and sewage system tax, sufferance tax, refuse matter tax, groundwater tax, ecological taxes and the energy tax. These taxes and their rates vary from municipality to municipality, so consultation with makelaar or notaris is necessary.

Germany

Property Transfer Tax: Transfer of German property is subject to a transfer tax (Grunderwerbsteuer)–the equivalent of UK stamp duty. Since 2007 this tax is no longer set at federal level and comes under authority of local governments.Fro example in Bavaria: 3.5%, Berlin: 6%, Bremen: 5%, Brandenburg: 5%, Hamburg: 4.5%, Lower Saxony: 5%, North Rhine-Westphalia: 5%, Rhineland-Palatinate: 5%, Saarland: 5.5% etc)

Annual Property Taxes: The real property tax burden is calculated by multiplying the assessed value of the real property, the real property tax rate and the municipal multiplier. The assessed real property value is determined by the tax authorities according to the German Assessment Code (Bewertungsgesetz). The German Assessment Code refers to historical property values that are usually significantly lower than current market value. The real property tax rate depends on the type of real property. The tax rate is e.g. 0.26% for property used for (semi-) detached houses with a value of up to EUR 60,000 and 0.35% for all remaining types of real property (including commercially used real property). Similar to the municipal multiplier applied in the trade tax case, the municipal multiplier applied to real property tax is stipulated by each municipality.

Austria

Property Transfer Tax: The transfer of Austrian real estate triggers a 3.5% (2% in case of intra-family transfers) Austrian real estate transfer tax. In 2012, the Austrian Constitutional Court ruled that the provisions in the Austrian Real Estate Transfer Tax on the tax basis are not in conformity with the country's constitutional law. Shortly prior to the expiry of the transition period, new provisions for determining the tax base for Austrian real estate transfer tax purposes entered into force as of 1st June 2014.

Annual Property Taxes: Property tax was abolished in 1989.

© 2015 broosco. All rights reserved.

Don't miss the conversation!

Join us to get the information you need, straight to your inbox...

SIGN UP